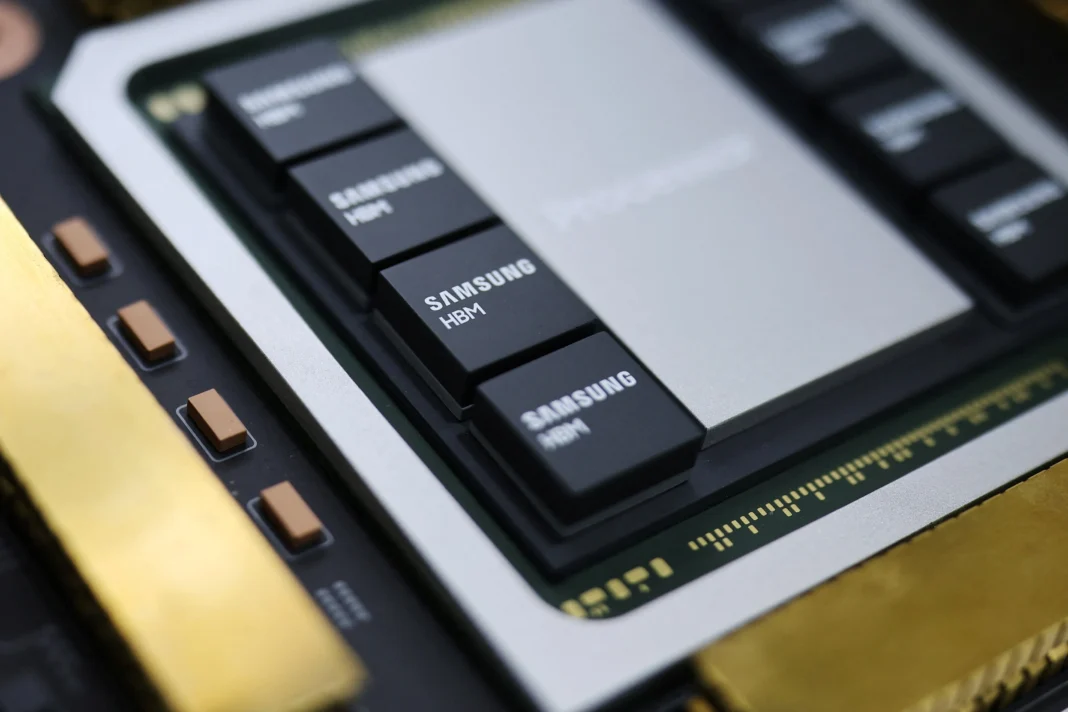

SEOUL — Samsung Electronics co-CEO Jun Young-hyun announced in a New Year address that customers are praising the “differentiated competitiveness” of the company’s next-generation HBM4 chips, signaling a potential turnaround in the high-stakes artificial intelligence (AI) hardware market. The semiconductor chief noted that clients have explicitly stated “Samsung is back,” as the firm works to narrow the gap with its primary rival, SK Hynix.

Despite this optimism, Samsung remains in a “close discussion” to supply these sixth-generation high-bandwidth memory solutions to industry leader Nvidia, trailing SK Hynix, which held a dominant 53% market share as of the third quarter of 2025. Investors reacted positively to the outlook, sending Samsung and SK Hynix shares to record highs on the year’s first trading day, gaining 7.2% and 4% respectively.

While the AI sector remains a primary growth driver, Samsung executives warned of a volatile 2026. Co-CEO TM Roh highlighted significant headwinds, including escalating component costs and global tariff risks, necessitating proactive supply chain diversification. Meanwhile, the company’s foundry division is eyeing a “great leap forward” following major contracts, including a $16.5 billion agreement with Tesla signed last July.

Analysis: The Geopolitical and Economic Shifts in Semiconductor Dominance

The semiconductor landscape is currently undergoing a seismic shift, transitioning from a period of “upside surprises” to a reality where AI-driven demand is the baseline for survival. Samsung’s struggle to reclaim its mantle from SK Hynix illustrates the “innovator’s dilemma” within the high-bandwidth memory (HBM) sector. While Samsung has historically dominated memory, SK Hynix’s early pivot to HBM3 and HBM3e allowed it to capture over half the market by late 2025. Samsung’s HBM4 strategy is not merely a product launch but a critical defensive maneuver to prevent a permanent duopoly favoring its compatriot.

Furthermore, the “global tariff risks” mentioned by TM Roh point to a broader trend of techno-nationalism. As nations implement protectionist trade policies to secure domestic chip supplies, manufacturers like Samsung must engage in “supply chain optimization” that often involves moving production closer to end-users in the U.S. or Europe. The $16.5 billion Tesla deal is a prime example of this diversification, moving Samsung beyond consumer electronics into the lucrative automotive AI sector. However, with rising component prices squeezing margins, the company’s ability to maintain its “core competitiveness” will depend on whether it can successfully execute its HBM4 rollout while navigating a fragmented global trade environment.