The Parisian tech titan Capgemini is making a high-stakes retreat from the American federal sector, announcing the immediate sale of its U.S. government subsidiary. The move comes just days after the company’s leadership was hauled onto the carpet by the French government to explain a controversial contract with U.S. Immigration and Customs Enforcement (ICE).

At the heart of the firestorm is a “skip tracing” agreement that reportedly incentivized the tech firm to track and locate undocumented immigrants during the Trump administration’s intensified 2026 enforcement surge.

A Corporate Firewall Crumbles

For years, Capgemini Government Solutions (CGS) operated behind a legal and technical “firewall” designed to satisfy U.S. national security regulations. This structure allowed the unit to handle classified U.S. contracts while theoretically keeping its French parent company at arm’s length.

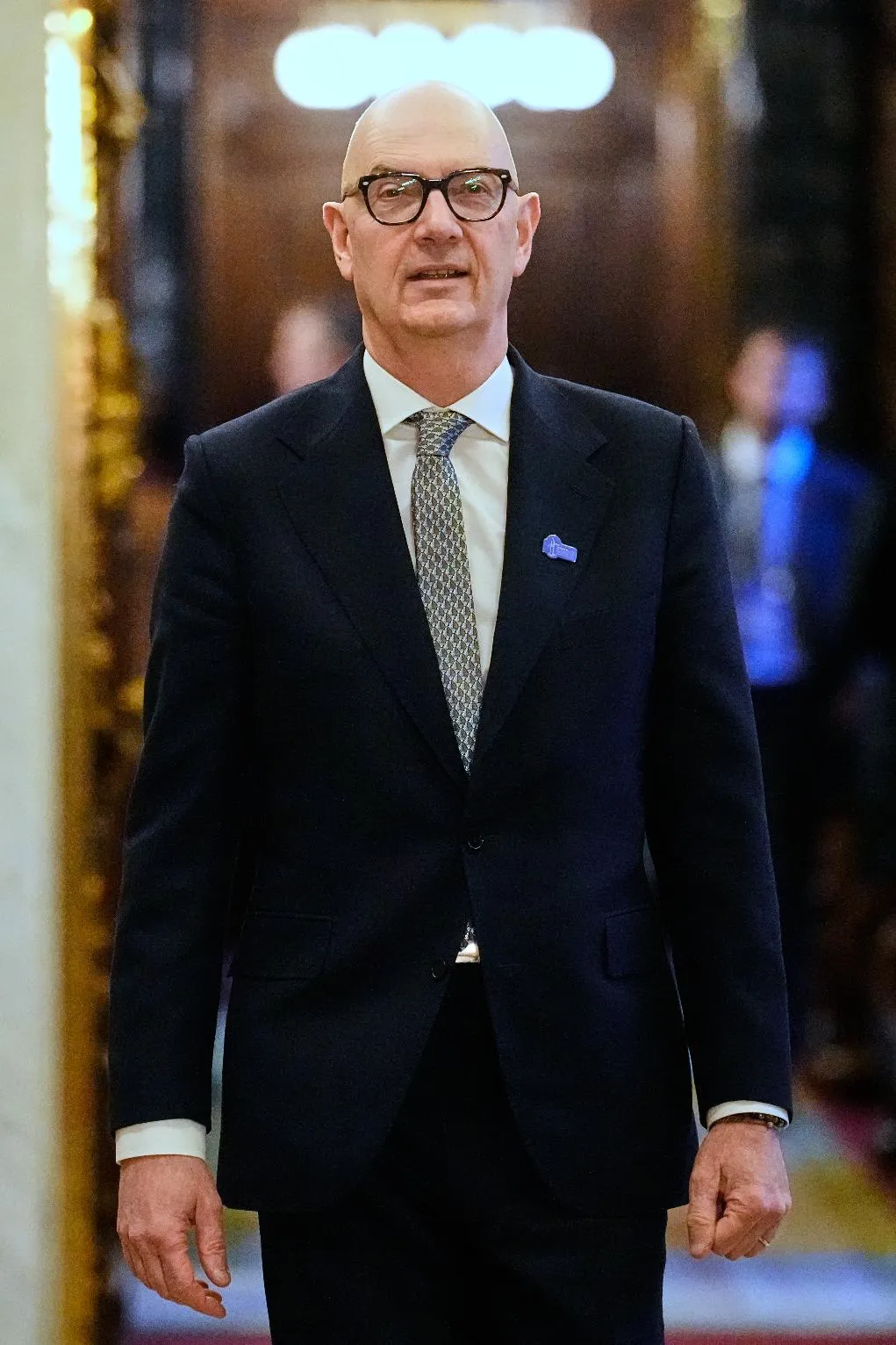

However, that separation became a liability when French Finance Minister Roland Lescure demanded “full transparency” regarding the unit’s involvement in the U.S. immigration crackdown. Lescure flatly rejected the idea that a parent company could remain ignorant of its subsidiary’s sensitive operations.

“The very least… one can expect is that a company which owns subsidiaries should know what is going on within those companies,” Lescure told lawmakers.

The “Skip Tracing” Contract: What We Know

The contract, signed in December 2025, involved services for ICE’s Detention Compliance and Removals office.

- The Price Tag: While the initial deal was valued at approximately $4.8 million, the framework allowed for a staggering ceiling of $365 million over two years.

- The Mission: CGS was set to provide “skip tracing” services—a technique used to locate individuals—specifically to assist in “enforcement and removal operations”.

- The Incentives: Reports indicate the deal included financial bonuses for successfully identifying and localizing foreign nationals.

Violence in Minneapolis Fuels the Backlash

The corporate crisis is unfolding against a backdrop of civil unrest in the United States. Public outcry intensified following the fatal shootings of two U.S. citizens—Renee Nicole Good and Alex Pretti—by federal immigration officers in Minneapolis earlier this year.

The deaths, occurring during a massive enforcement operation known as “Metro Surge,” turned the Capgemini contract from a private business deal into a public relations nightmare. Capgemini CEO Aiman Ezzat admitted the nature of the work “raised questions” compared to the firm’s typical technology services.

Why This Matters: The New “Ethical Sovereignty”

This divestment marks a rare instance of a global tech firm severing a lucrative U.S. government relationship due to ethical pressure from a foreign government. It highlights a growing “sovereignty clash” where European ESG (Environmental, Social, and Governance) standards collide with the “firewalled” reality of U.S. defense and security contracting.

By selling the unit—which represents roughly 0.4% of its global revenue—Capgemini is choosing to protect its brand over its footprint in the D.C. Beltway. For other international contractors, the message is clear: the corporate firewall may no longer be thick enough to block the heat of political scrutiny.

Takeaways

- Immediate Divestment: Capgemini is selling CGS after concluding it cannot “exercise appropriate control” over the unit’s operations.

- Political Pressure: The decision followed intense questioning from the French government and internal protests from European labor unions.

- U.S. Impact: The move removes the lead contractor from a high-profile $365 million migrant tracking program.