NEW YORK — Leading multi-manager hedge funds achieved significant double-digit gains in 2025, capitalising on an artificial intelligence-driven equity surge and heightened volatility within global bond and currency markets. Bridgewater Associates outpaced its primary competitors, with its flagship Pure Alpha fund yielding 34%—the highest profit margin in the firm’s 50-year history.

D.E. Shaw also reported substantial growth, as its Oculus and Composite funds climbed 28.2% and 18.5% respectively. Other top performers included Point72 Asset Management, which saw a 17.5% jump, and Balyasny Asset Management, which gained 16.7%. While the industry reached record asset highs, some major players like Millennium (10.5%) and Citadel’s Wellington fund (10.2%) trailed their peers after enduring early-year headwinds linked to shifting trade policies.

The Architecture of Alpha: How 2025 Redefined Hedge Fund Performance

The stellar performance of the hedge fund industry in 2025 was not merely a byproduct of a rising tide but rather a masterclass in navigating a “whiplash” macroeconomic environment. This success was anchored by two primary catalysts: the transformative power of generative AI and the tactical exploitation of geopolitical instability.

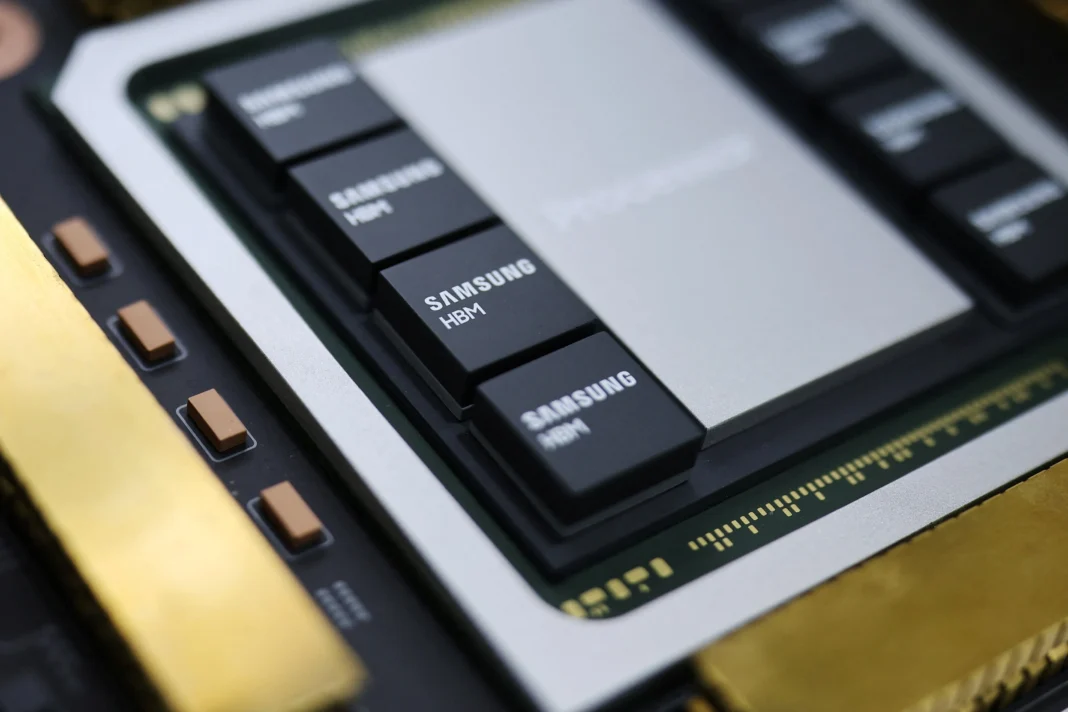

The AI-Powered Equity Surge The U.S. stock market’s 16% rise was largely propelled by a narrow yet potent euphoria surrounding artificial intelligence. For instance, as tech giants and semiconductor manufacturers reached record valuations, multi-strategy “pod shops”—firms that deploy specialised teams to manage distinct asset classes—leveraged active portfolio shuffling to capture these gains. This represents a shift from traditional value investing to a high-velocity model where technical expertise in emerging technologies becomes a critical competitive advantage.

Volatility as a Strategic Asset While retail investors often fear market fluctuations, 2025 demonstrated how sophisticated managers use volatility to generate “alpha” (returns exceeding the market average). Trade policies and geopolitical maneuvers triggered significant price swings in bond and currency markets. Large global macro funds, such as Bridgewater, successfully anticipated these shifts, converting market turbulence into the most profitable year in their operational history. By engaging in price arbitrage—buying and selling assets simultaneously to profit from price imbalances—these firms turned political uncertainty into a predictable revenue stream.

The Resilience of the Multi-Strategy Model The year also solidified the dominance of the multi-manager structure. Despite record volatility, firms like D.E. Shaw and AQR Capital Management maintained steady annualized returns by diversifying across stocks, commodities, and private markets. Even those who “lagged,” such as Citadel, still maintained long-term annualized net returns of approximately 19% since inception, proving that the hedge fund industry’s current institutional weight is supported by robust, consistent historical performance